is car loan interest tax deductible in india

If its a loan for buying a commercial or. Hence for that year you will only have to pay tax for.

This Monsoon Keep Dry Sbi Makes Your Dream Car Affordable With Zero Foreclosure Charges And No Pre Payment Penalty For Your Com Car Loans Dream Cars Banking

For this you take a loan of 10 lakhs at 12 interest for one year.

. The interest paid on a business loan is usually deducted from the gross income. An individual taxpayer can claim interest on loan of an electric vehicle of up to INR 15 lacs us 80EEB. The interest rates for the car loans in India start at as low as 665 pa.

The interest you pay on your business is tax deductible that is generally subtracted from your gross income. You can claim tax benefits only on interest. Answer 1 of 2.

However the income-tax act does not specifically entertain any tax deductions on your income-tax returns when it comes to personal loans. Based on your credit rating you can avail a car loan which finances up to 100 of the on-road price of the car. Car loans availed by individual customers.

However all types of interests are not. If a Salaried person takes a Car Loan then he cannot claim the Interest on Car Loan as an expense. Show you use the car for legitimate business.

You may also get a tax deduction on the car loan interest if youve taken out a chattel mortgage where the vehicle acts as the security for the loan. If the car is being purchased for use in business the interest on the loan should be allowable as deduction in computing the taxable income as interest on any other loan taken for purchasing. So your total taxable profit for the year.

Due to the lack of direct mention of. In Indian context if the loan is taken for business than you can claim interest paid on mortgage loan as deduction from business profits. If the taxable profit of your business in the current year is Rs 50 lakh Rs 24 lakh 12 of Rs 20 lakh can be deducted from this amount.

The Income-tax Act of India has rules for tax deductions and exemptions on both the principal and interest of certain loans. A person running a business can claim interest on car loan as deduction of Interest on car loan from his Profit computed under. As per the Income Tax Act 1961 you can avail.

The benefit Section 80EEB can be claimed by individuals only. It is only allowed to be treated as an. Is car loan interest tax deductible in india.

Tax Deduction for Interest paid on Car Loan The Interest paid on some types of Loans is allowed to be claimed as an Expense under the Income Tax Act. If you are an employee. How to show home loan interest for self occupied house in.

On a chattel mortgage. These include home loans education loans business loans etc. 08 February 2008 Respected members.

If your taxable income from the business is 30 lakhs for the year then 88 lakhs which is 12 of 10 lakhs can be deducted from your annual income while paying tax. Only self-employed people or owners of their own business who use a vehicle for business purposes can claim a tax deduction for interest on car loans. Principal loan amount is not tax deductible and do not offer any tax benefit.

The answer is Yes. Mahesh Padmanbhan answers In case you are a professional or a business man declaring income under the head profits or gains from business or profession then the interest. Car loans availed by self-employed individuals for vehicles that are used for commercial purposes are eligible for tax deduction under section 80C of the Income Tax Act Tax Exemption on.

Reducing Tax Burden Different Sections Like 80c 80d Etc Detailed Infographic By Livemint Incometax Public Provident Fund Tuition Fees Tax Deductions

Tax Benefits On Car Loan What Is It How To Claim Tax Benefits Idfc First Bank

India Post Payments Bank Teams Up With Hdfc For Offering Home Loans Personal Loans The Borrowers Loans For Bad Credit

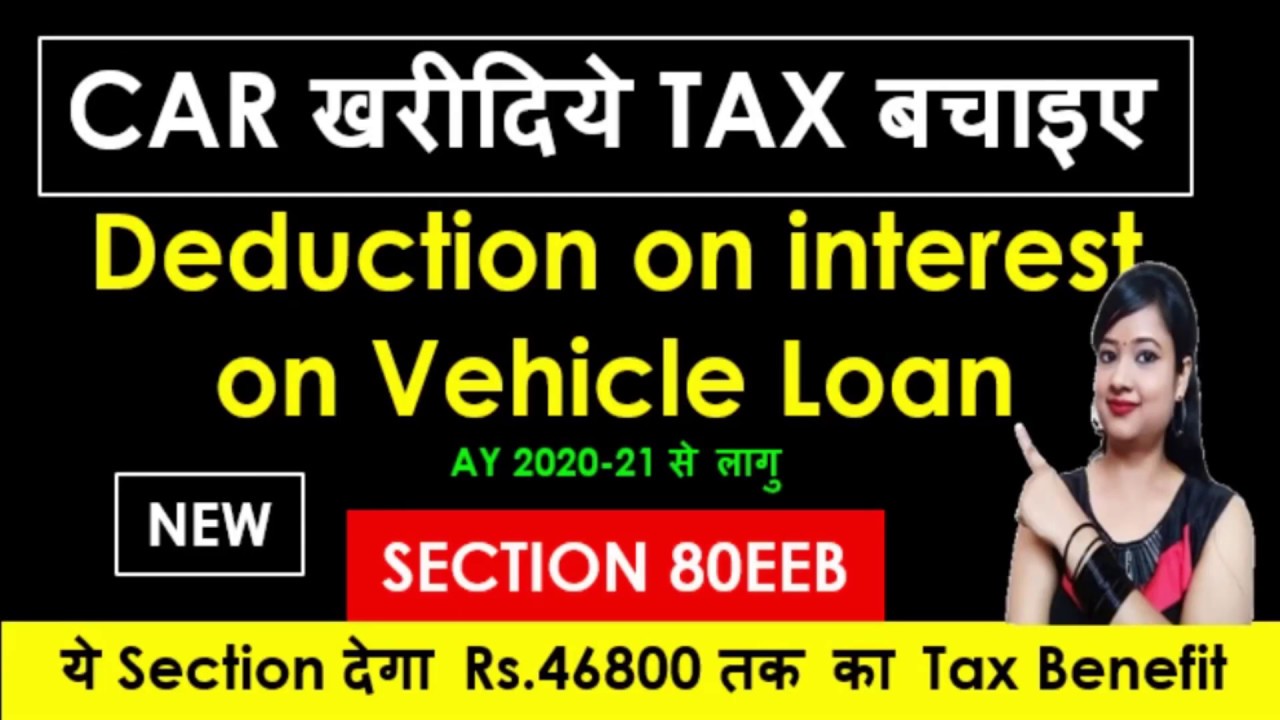

New Income Tax Deduction U S 80eeb On Car Loan Deduction On E Vehicle Loan Interest 80eeb Youtube

Tax Benefits On Car Loan What Is It How To Claim Tax Benefits Idfc First Bank

Personal Loan Tax Deduction Tax Benefit On Personal Loan Earlysalary

Every Thing About Car Loan Tax Benefit Paysense Blog

Car Loan Tax Benefits On Car Loan How To Claim Youtube

How To Claim Student Loan Tax Credits And Deductions Student Loan Hero

Understanding The New 2019 Federal Income Tax Brackets Slabs And Rates Tax Brackets Federal Income Tax Income Tax Brackets

Tax Write Off Opt In Freebitcoin Yeahright Bookkeeping Business Business Tax Business Tax Deductions

/what-are-differences-between-delinquency-and-default-v2-dfc006a8375945d4b63bd44d4e17ffaa.jpg)

Delinquency Vs Default What S The Difference

Car Loan Tax Benefits And How To Claim It

Home Loan Home Loans Debt Relief Programs Home Improvement Loans

Pin By Fundoomoney On Equity Linked Savings Scheme Elss Investing Personal Finance How To Plan

Income Tax Paying Taxes The Outsiders Income Tax

How Much Of Your Car Loan Interest Is Tax Deductible Bankrate